World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 24 April 2025

The US authorities continue to make mutually exclusive statements almost daily, increasing volatility in global stock indices. Find out more in our analysis and forecast for global indices for 24 April 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the S&P US composite PMI was preliminarily 51.2 in April

- Market impact: a slowing composite PMI indicates weaker economic activity in general, potentially dampening investor optimism

Fundamental analysis

The slowdown in business activity increases the likelihood that the Federal Reserve will be more cautious about rate hikes, which could moderately support the stock market, especially rate-sensitive companies such as the technology sector. The manufacturing sector appears rather stable, while the service sector has weakened, creating a mixed and volatile backdrop for the stock market.

US President Donald Trump has said he does not plan to put pressure on Federal Reserve Chairman Jerome Powell. Nevertheless, Trump continues to insist on an immediate rate cut, while the Fed chair is concerned about rising inflation.

US 30 technical analysis

The US 30 stock index remains in a downtrend despite the renewed optimism. If the 37,060.0 support level does not break, a sideways movement could follow.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 37,060.0 support level could send the index down to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

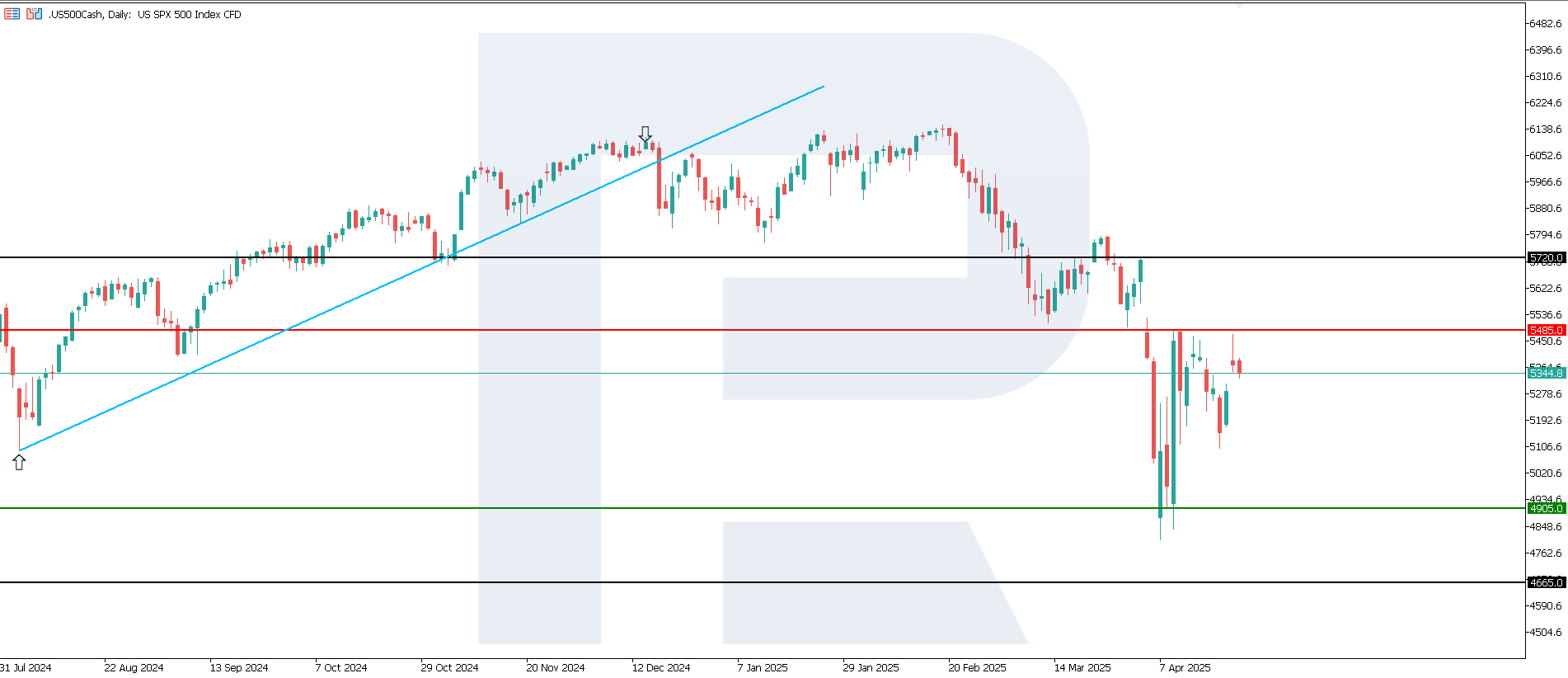

US 500 technical analysis

The US 500 stock index is testing the 5,485.0 resistance level. If the price breaks above this mark, the uptrend will continue. However, it is worth noting a significant increase in index volatility, which weakens further growth potential.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 4,905.0 support level could push the index down to 4,665.0

- Optimistic US 500 forecast: a breakout above the 5,485.0 resistance level could push the index to 5,720.0

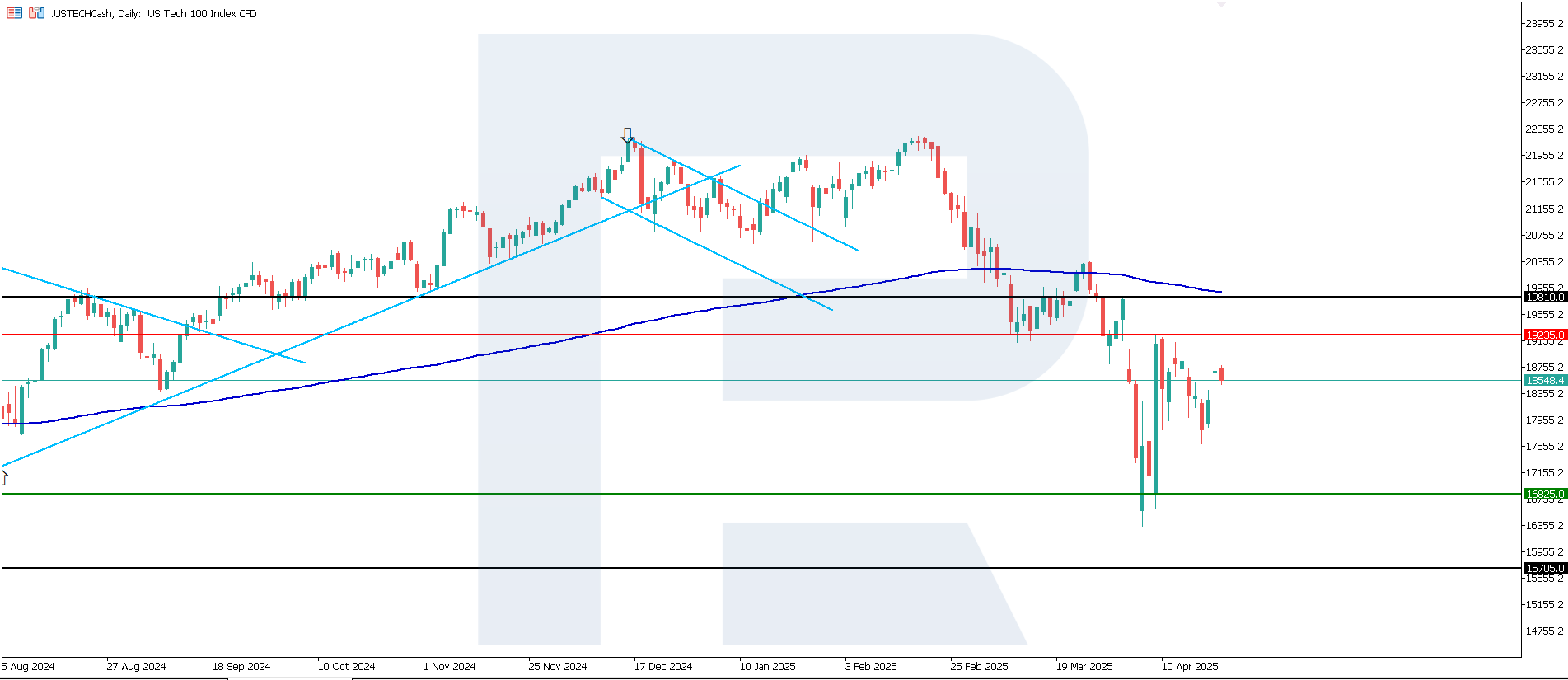

US Tech technical analysis

The US Tech index formed a resistance level at 19,235.0, with support at 16,825.0. The current uptrend is rather weak and is likely to be short-term as quotes are trading below the 200-day Moving Average.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 16,825.0 support level could send the index down to 15,705.0

- Optimistic US Tech forecast: a breakout above the 19,235.0 resistance level could propel the index to 19,810.0

Asian index forecast: JP 225

- Recent data: Japan’s composite PMI was preliminarily 51.1 in April

- Market impact: the composite PMI shifted from contraction to growth territory, which could improve investor sentiment

Fundamental analysis

The uptick in the composite PMI above 50.0 for the first time in recent memory is a positive signal, indicating an improving economic situation in the country. This could boost investor confidence and support the stock market growth. Meanwhile, the industrial sector remains weak, potentially putting pressure on shares of Japanese exporters and manufacturers.

More robust overall business activity reduces the likelihood of aggressive monetary stimulus and may ease pressure on the yen. The PMI data sends a moderately positive signal for the Japanese stock market, showing a strengthening general economic environment. The service sector sees the most pronounced positive developments, with the manufacturing sector remaining weak. Investors may take an interest in stocks of companies focused on the domestic market, while being cautious about shares of industrial and export companies.

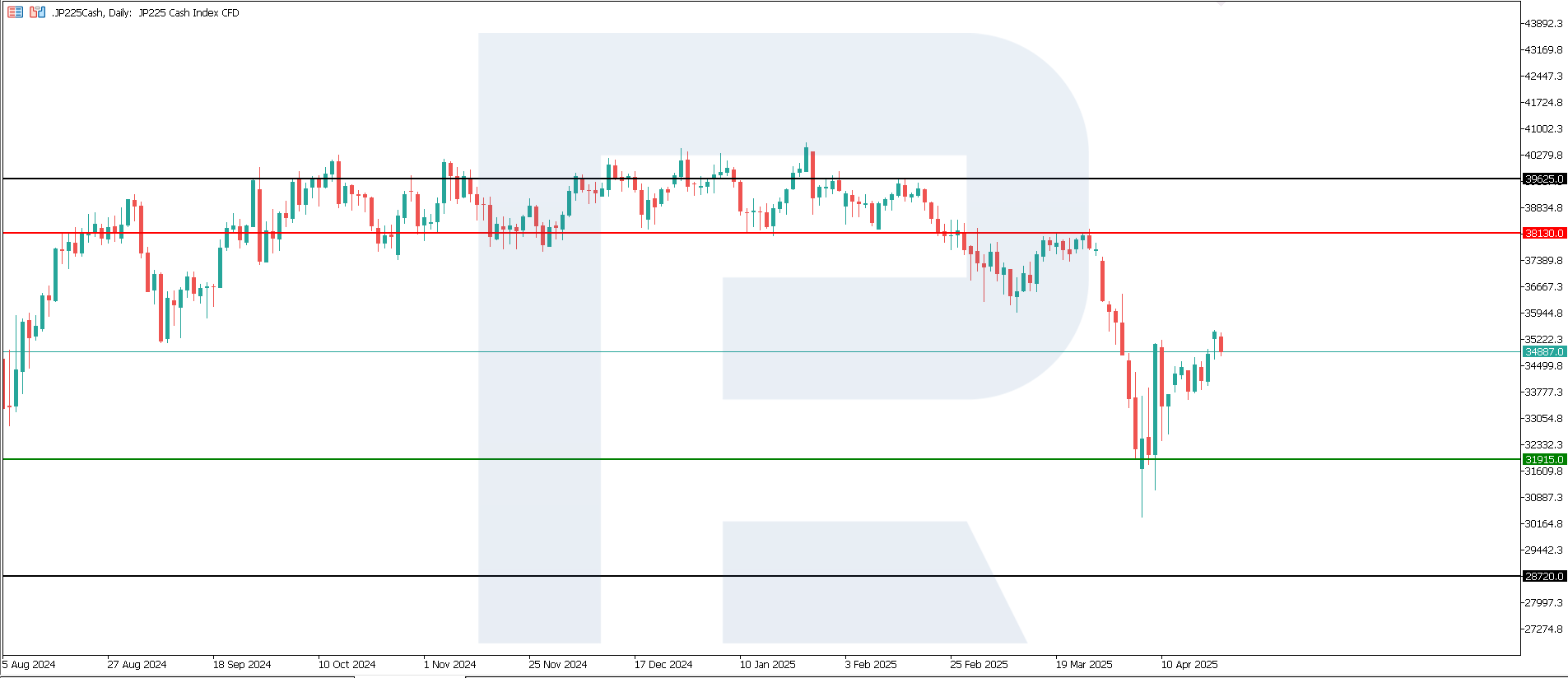

JP 225 technical analysis

A medium-term sideways range is most likely to form in the JP 225 stock index. Overall, the trend remains downward. However, a false breakout below the 31,915.0 support level is possible, which could trigger a trend reversal. That said, this is unlikely in the short term.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,915.0 support level could push the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: the German composite PMI preliminarily came in at 49.7 in April

- Market impact: composite PMI below 50.0 indicates a contraction in overall business activity, fuelling investor concerns about a recession

Fundamental analysis

The service sector has previously supported the economy but now begun to contract, which is negative for companies dependent on domestic demand. The continued decline in the manufacturing PMI is putting pressure on stocks of industrial and export-oriented companies. Weak PMI data increases the likelihood that the ECB will adopt a softer monetary stance, partially supporting the stock market in the medium term due to expectations of lower interest rates.

The German PMI data for April gives a clearly negative signal, indicating a weakening economy. This exerts short-term pressure on the stock market, especially the service and manufacturing sectors.

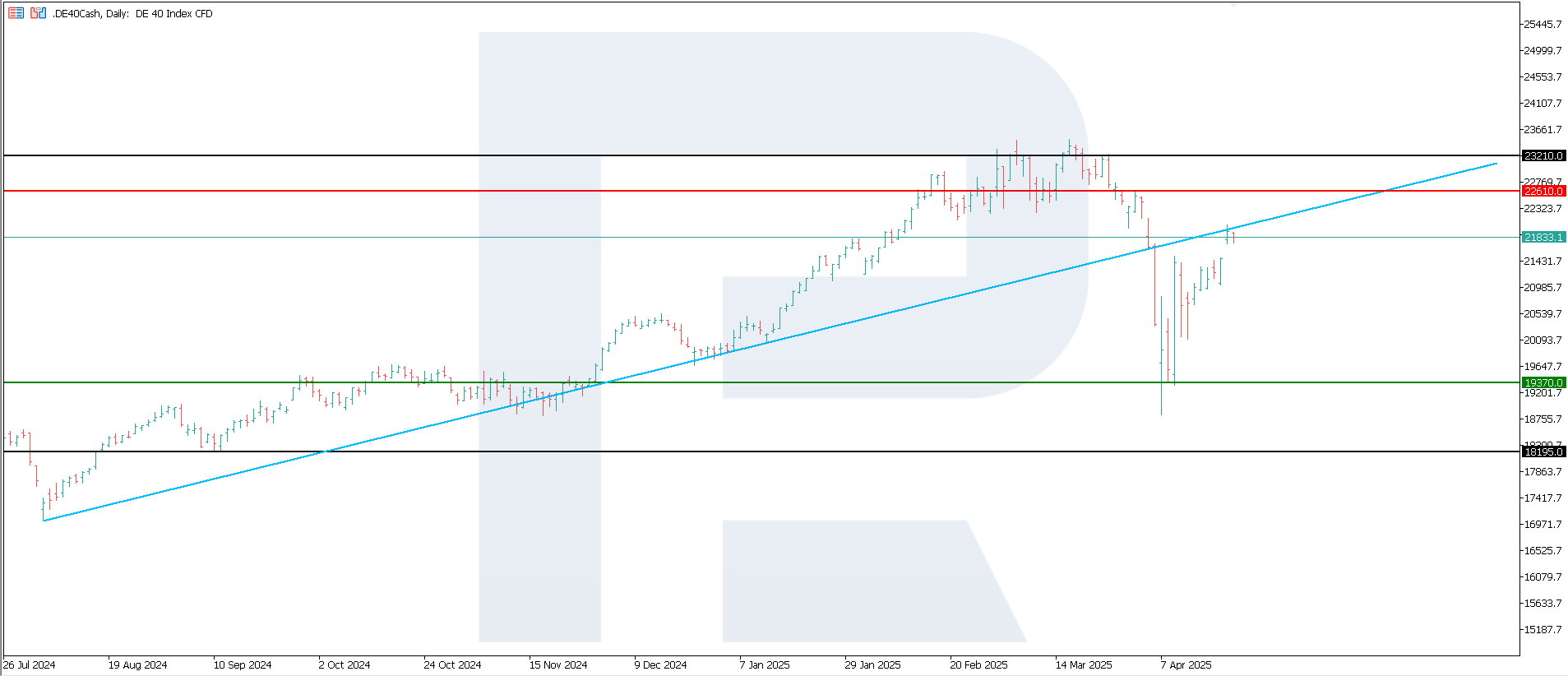

DE 40 technical analysis

The DE 40 stock index may enter a sideways channel if the price fails to break above the 22,610.0 resistance level. The support level formed at 19,370.0, leaving minimal room for a directional movement.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 19,370.0 support level could push the index down to 18,195.0

- Optimistic DE 40 forecast: a breakout above the 22,610.0 resistance level could drive the index to 23,210.0

Summary

The ECB lowered the key rate to 2.40% in line with analysts’ forecasts, which is positive for the German stock market. However, the ongoing uncertainty due to the US tariff policy and contradictions between the government and central banks is curbing the growth of global indices. The growth potential is over, with investors awaiting new drivers. The US 500 and US Tech indices are the only ones to see the uptrend.